how far back does the irs go to collect back taxes

Under IRC 6502 a 1 once the IRS has assessed the tax it has 10 years to collect it from the date of assessment. For most cases the irs has 3 years from.

How Far Back Can The Irs Collect Unfiled Taxes

An IRS Audit Can.

. The IRS can go back as far as six years but generally youll only see audits for up to three years. In most cases the IRS goes back about three years to audit taxes. The irs is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

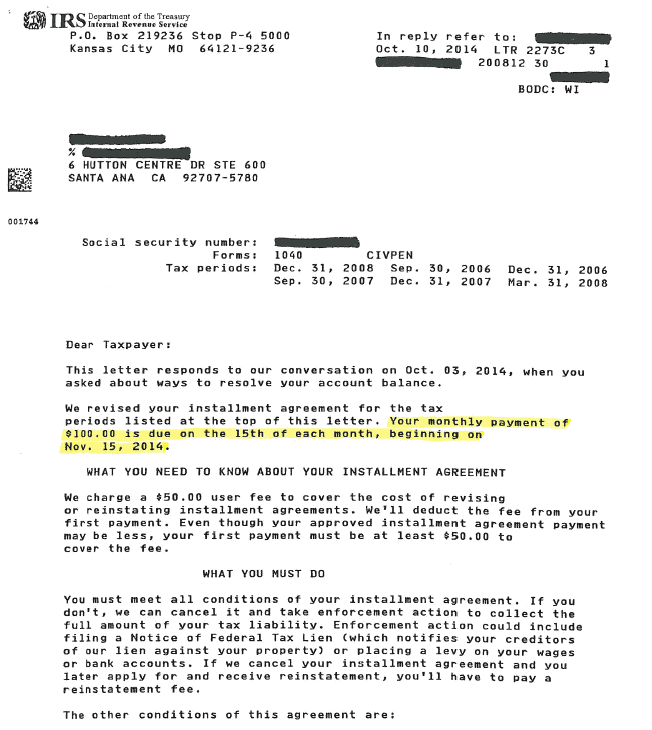

In most cases the IRS requires you to go back and file your last six years of tax returns to get in their good graces. Only Go Back Six Years. Before starting this process call the IRS or a trusted tax professional.

What you ought to appreciate is that it isnt as simple as it sounds. IN GENERAL the IRS has 3 years from the date a return is filed to make an assessment and 10 years from the assessment to collect any deficiencies. Once 10 years have passed the IRS can no longer collect on your tax debt from unfiled taxes.

You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. See if you Qualify for IRS Fresh Start Request Online. However that 10 years does not begin when you neglect either accidentally or willfully to file your return.

The irs is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. In most situations the IRS can go back three years. Note that the statute of limitations on collections used.

In fact the 10. It is true that the IRS can only collect on tax debts that are 10 years or younger. Up to 25 cash back Generally IRS can collect taxes for income taxes for ten tax years.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. If only one half of the couple owes money. Owe IRS 10K-110K Back Taxes Check Eligibility.

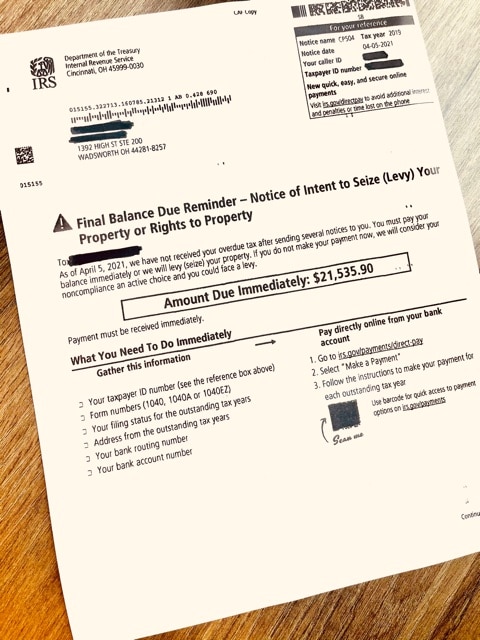

And then to make arrangements on payment of what is. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account.

How Long Can the IRS Collect Back Taxes. Confirm with them that you only have to go back as far as the past six years for. This means that the IRS has 10 years after assessment to.

The IRS 10 year statute of limitations starts on the day that your. That means if your 2016 tax return was due April 2017 the IRS has three years from April 2017 to audit you if you file the return timely. IRS Previous Tax Returns At the very most the IRS will go back six years in an.

Ad Owe back tax 10K-200K. When a married couple filing jointly owes a federal debt the IRS may seize their tax refund in order to offset the money that they owe. The time period called statute of limitations.

For most cases the. There is an IRS statute of limitations on collecting taxes. That means taxes due for tax year 2001 can be collected until April 2012.

For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. There is a 10-year statute of limitations on the IRS for collecting taxes.

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Irs Tax Letters Explained Landmark Tax Group

Irs Tax Debt Relief Forgiveness On Taxes

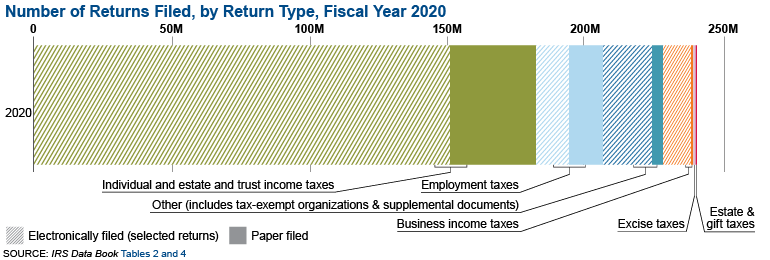

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

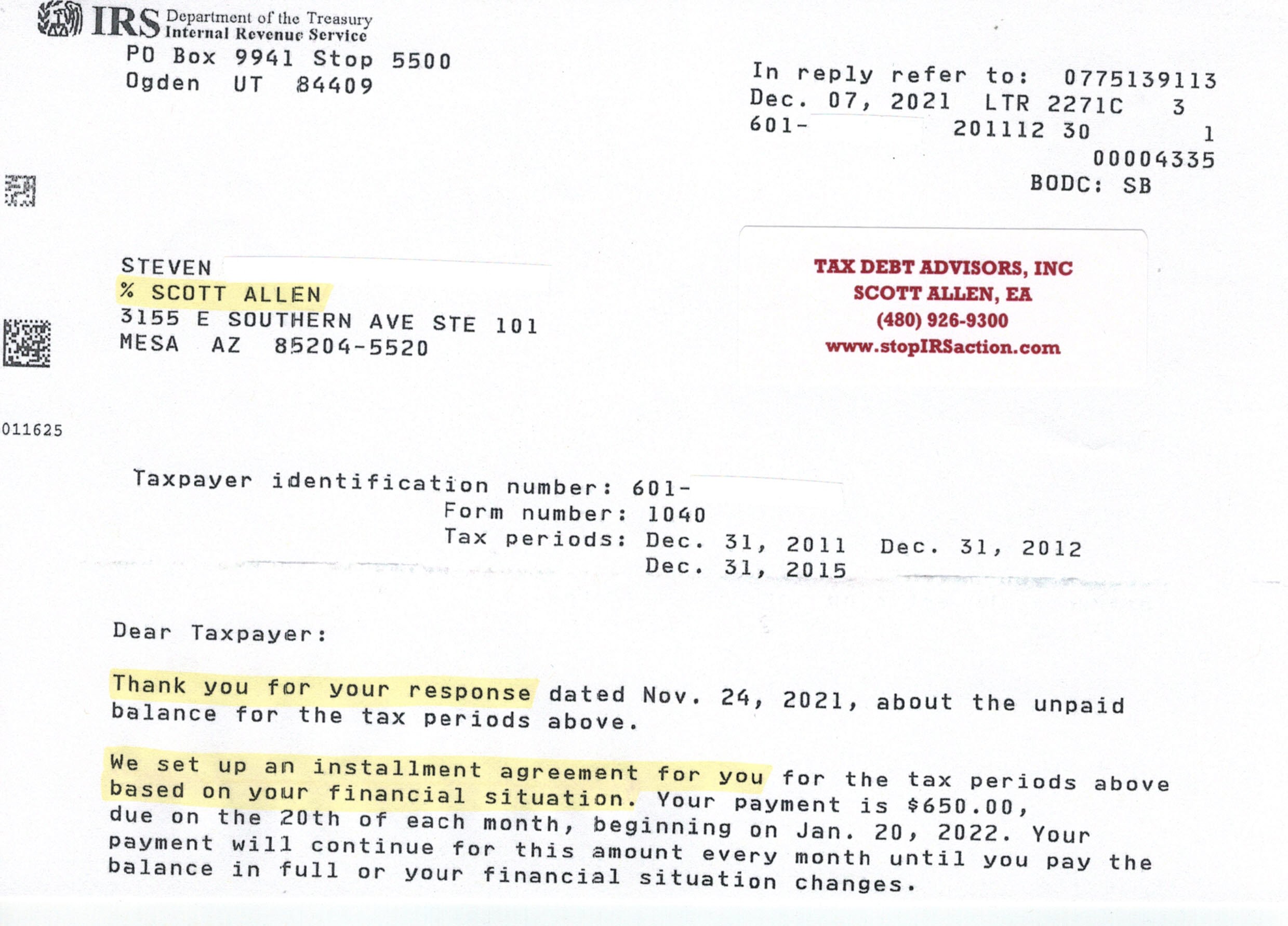

Back Tax Returns Tax Debt Advisors

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

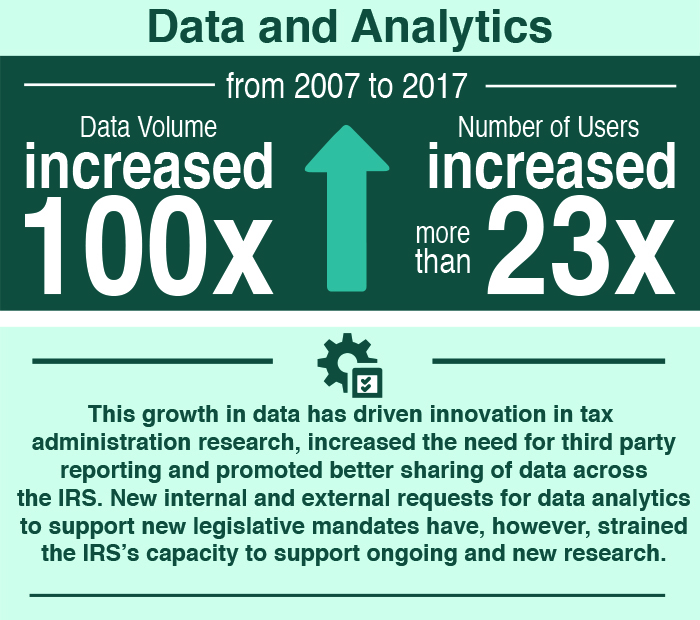

Advance Data Analytics Internal Revenue Service

How Do I Know If I Owe The Irs Debt Om

Know What To Expect During The Irs Collections Process Debt Com

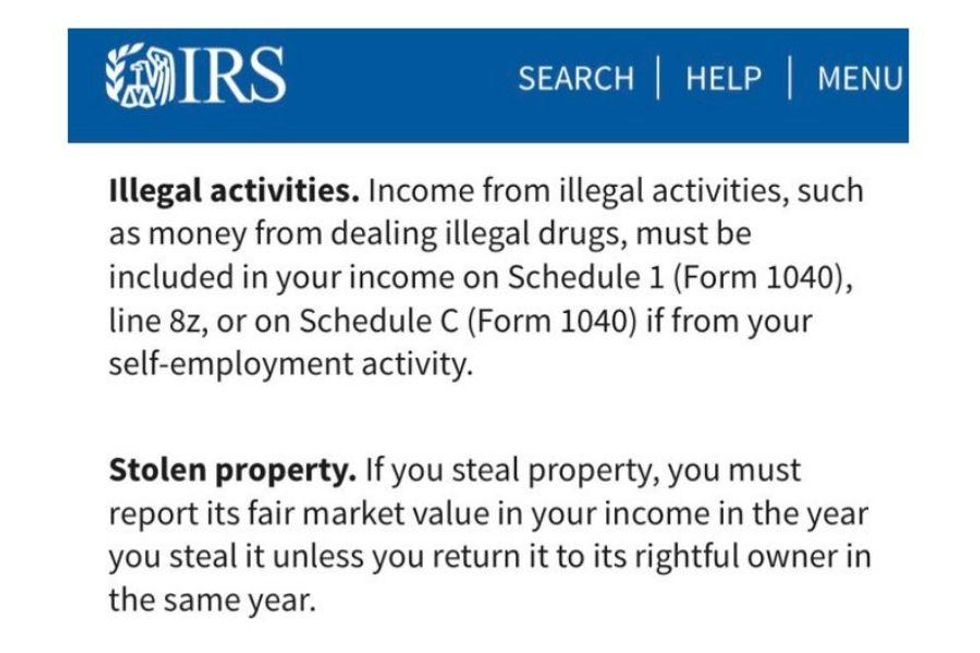

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

How Long Can The Irs Try To Collect A Debt

How To Report Tax Fraud To The Irs Privacyguard

Are There Statute Of Limitations For Irs Collections Brotman Law

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes